deferred sales trust example

Benefit of a Deferred Sales Trust. Deferred sales trusts also come with a number of caveats that have the potential to increase investment risk.

Trust Agreement Pdf Templates Jotform

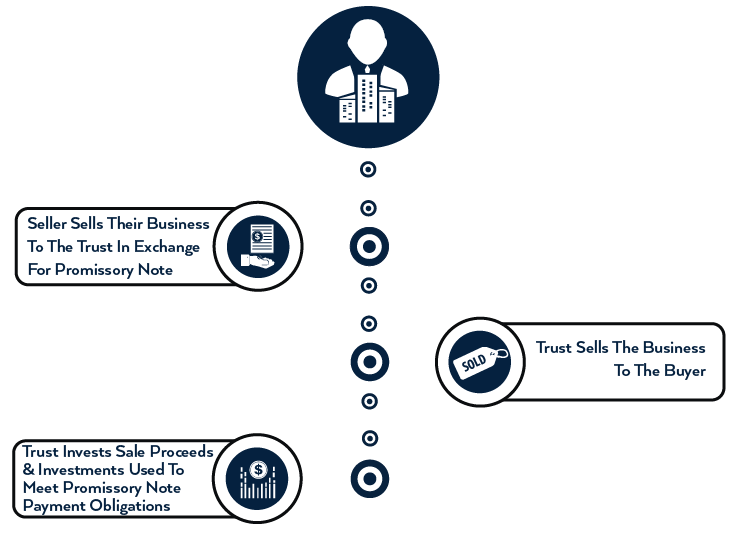

The deferred sales trust is a legal contract between the seller and the Freedom Bridge Capital trust.

. By Rick Durfee April 6 2020. They do not work for primary homes for businesses for cryptocurrency or highly. A capital gains tax deferral strategy.

The concept is a lot less exciting as. In the above example there would be no taxes due with a Deferred Sales Trust. Wners of businesses real estate and other highly appreciated assets are oft en reluctant to sell due to the signifi cant capital.

1031 exchanges really only worked for investment real estate. Binkele and attorney CPA Todd Campbell. Easy to Use Online Templates.

If you own a business or real estate with a large amount of gain and are not selling your property because of capital gain taxes or cant find. The trust acts as a third party to help facilitate the sale of your business or property. Deferred sales trust example.

Current DST Properties and Sponsors. Unlike a 1031 exchange a DST does. For example with a Deferred Sales Trust you sell an asset to a trust at its fair market value with no capital gains taxes.

Step-by-Step Instructions on All Devices. The Deferred Sales Trust has the ability to generate substantially more money over the long run than a direct and taxed sale. Ad Create a Custom Living Trust Form to Control What Happens to Your Assets.

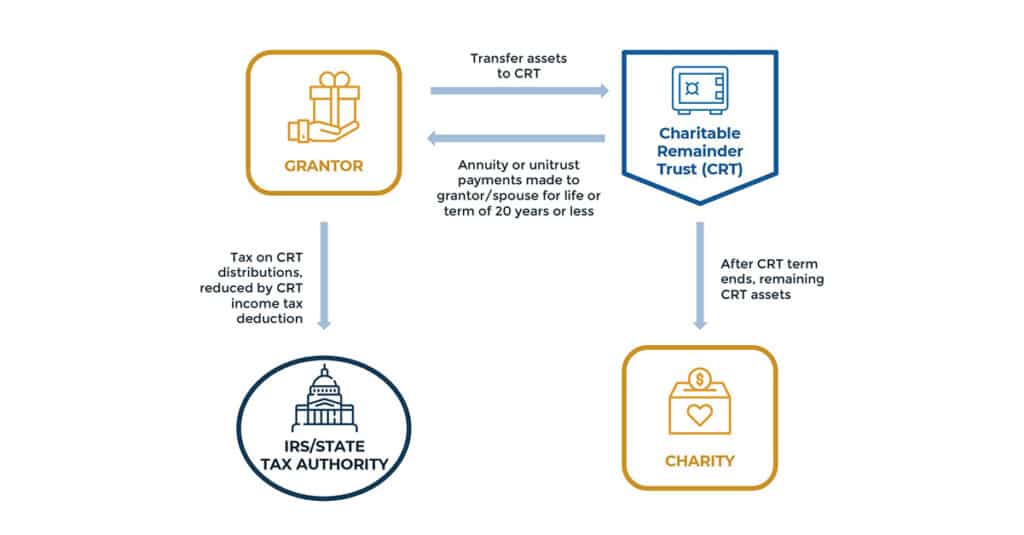

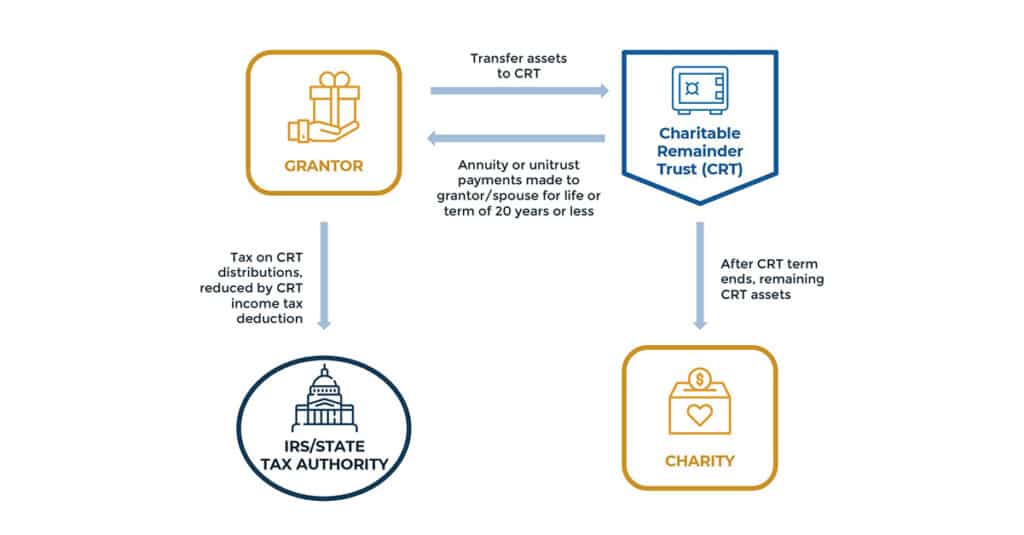

Deferred Sales Trust Costa Mesa CA Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital. You may be interested to hear the experiences of other business and property owners who have sold their assets to the deferred sales trust. The Deferred Sales Trust is a legal contract between you and a third-party trust in which you sell real or personal property or a business to the Deferred Sales Trust in exchange.

In turn they will pay for it over time in multiple future installments. Deferred Sales Trust. How I helped Steve to sell his 19M multifamily complex and save 280000 in capital gains tax without having to do a 1031 exc.

Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr. A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like.

Deferred Sales Trust Case Studies. Potential Disadvantages of Deferred Sales Trusts. Here is another example of a couple in California selling a highly appreciated residential property in California.

An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST. It is also superior to a direct installment sale as the concerns of a. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties.

Take an elderly couple for example. The major benefit of the Deferred Sales Trust is tax deferral with the freedom to choose investment options. Current DST Properties and Sponsors.

For over 20 years now Deferred Sales Trust has allowed businesses and real estate investors to defer capital gains tax and generate more money through reinvestments in the long run more.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Capital Gains Tax Deferral

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust The Other Dst

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Selling My Business Capital Gains Tax Business Sale

Revenue Recognition On Sales Orders Finance Dynamics 365 Microsoft Docs

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Installment Sale To An Idgt To Reduce Estate Taxes

![]()

Deferred Sales Trust Atlas 1031

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

Deferred Sales Trust Defer Capital Gains Tax

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Charitable Remainder Trusts Crts Wealthspire